0. 내부환경의 이해

1. 수익성

- 산업 평균과 비교하여 경쟁자/산업 평균 대비 우리가 얼마나 잘하는지 분석

- 단, 신생 기업일 경우 Break-even point 보기

[문제해결능력]

- MECE principle : 문제를 잘 쪼개어서 보기

(Mutually Exclusive and Collectively Exhaustive) - 원인이 작은 부분은 무시하고 중요한 부분에 집중하기

- Revenue - cost에서 어떤 부분이 문제인가 -> 더 큰 문제만 집중해서 봐라

- revenue = p*q = p가 적거나 q가 적거나

- cost 가 너무 크거나

- Revenue - cost에서 어떤 부분이 문제인가 -> 더 큰 문제만 집중해서 봐라

1) 투자자본 수익률 : ROIC (Return on Invested Capital)

자본을 통해 나온 수익

ROIC가 높아야지 수익성이 높은 것!! 낮다면 그 이유를 분석해봐야 함

Pretax Return on Invested Capital (ROIC)

= Return on Sales (ROS, 매출액 수익률) * Capital Turnover(자본회전율)

*매출액 수익률 : 매출액 대비 수익의 비율

*자본회전율 : 자본에 대한 매출액(연 환산)의 비율을 말하며, 1년 동안 자본을 얼마나 회전시켰는가

ROS랑 Capital Turnover가 둘 다 높아야 수익성이 높음 !

ROS = 1 - (cost/sales) : 손익계산서 확인

Cost = Cost of goods sold + Sales&Administration(판관비) + Depreciation (감가상각비) 등등

cost가 높으면 문제!!!

어떤 cost가 높은지 살펴보고, 그 부분을 해결해야 함

위 그림에서 경쟁사 평균 대비 판관비가 너무 높음 = 이게 문제야

Capital Turnover = 1/(IC/S) = 매출액(Sales)/투하자본(Invested Capital)

투하자본(Invested Capital) = Net Property Plant and Equipment (PP&E, 유형자산) + Working Capital(운전자본) + Other Fixed Assets (기타 고정자산)

*운전자본 : 유동자산 - 유동부채

IC가 높으면 문제!!!

어떤 IC가 가장 높은지 살펴보고, 그 부분을 해결해야 함

위 그림에서 고정자산인 NPP부분과 Working Capital부분이 경쟁사 대비 특히 높음 = 이게 문제임

2) 경제적 부가가치 : EVA (Economic Value Added)

경제적 부가가치인 EVA는 회계적 수익성과 다름!

'Cost of capital, 자기자본 비용(=기회비용)'이 회계적 수익성에는 안잡히기 때문!

이를 고려한 것이 EVA임

EVA = (ROIC-WACC) * Invested Capital

WACC (Weight of cost of capital)

: "기회비용 + 이자"를 CAPM(Capital asset pricing model)을 이용해 자본 비중을 둬서 구하는 것

- Cost of Equity (=자기자본비용)

- Cost of Debt (=타인자본비용)

- Company A, B는 매출과 순이익이 같으므로 수익률은 동일하다

- A회사는 Capital Structure가 100% 부채이므로 이가 수익률에서 반영이 된 상태

- B회사는 Capital Structure가 100% 자기자본 비율인데, 이는 수익률에 반영이 안된 상태

- 따라서 A회사의 EVA는 10 그대로인 반면, B회사의 EVA는 (10-a)

- 따라서 EVA는 A회사가 더 크다

3) 현금흐름

현금흐름이란?

: 일정 기간에 유입된 돈

즉, 기업이 영업 활동을 통해 매출을 올리고 투자를 하며 이에 수반하는 비용을 차감하고 난 뒤 남은 돈

- 영업현금 흐름 : cash flow statement 잘 보기

- 잉여현금 흐름 (FCF) : 경쟁력 확보에 필요한 투자를 다 한 뒤 남은 현금

- 재무 측면 : 주주에게 돌려줌 (배당금, 자사주 매입 등)

- 전략측면 : 있는 걸 다 돌려주지 않고 기회가 올 때 투자 기회를 잡아야 함

- 어느정도 돌려줄지 배당 정책을 잘 살펴봐야 함 (ex. FCF의 몇%를 돌려준다)

- 현금흐름표가 없다면 영업이익 + depreciation으로 빠르게 알 수 있음

2. 시장 성과

- 수익성이 좋다고 항상 시장성과가 좋은 것은 아니므로 따로 봐야 함!

시장점유율(market share)

- MECE하게 Market Covered와 uncovered로 나누기!

- 수도권 vs 비수도권

- 고가 vs 중저가

- Covered 중에서 lose/win 분석하고, 그 중 win이 Market Share

- Winning ratio = win / covered

- 같은 MS라도 market covered가 몇인지에 따라 winning ratio가 달라진다

- winning ratio가 높을 수록 경쟁력이 높음

우리가 했던 넥슨 분석으로 생각해보면,

- 넥슨은 전세계 게임 시장 중, 아시아+북미/유럽 시장을 covered 하고 있음

- 그 중에서 1.25% 만 win 하고 있음

- 아시아 59.31% 중에서는 1.16% win

- 북미/유럽 40% 중에서는 0.09% win

시장누수분석 (Leakage Analysis)

- Total Market 중에서 Share of Market이 아닌 부분이 바로 Leaked Market

- Leaked Market이 왜 발생하는지 원인을 분석해보는 것이 필요함!

가능한 원인은 다음이 있음

- Product not offered

- 기술이 부족함 (technology gap)

- 생산 캐파가 안됨 (Production Capability)

- Customers not covered

- 유통채널이 없음 (Distribution Network)

- 판매력이 안좋음 (Salesforce deployment)

- Customers competed for and lost : 경쟁은 하고 있지만 win하지 못하고 있는 것

- A/S 서비스가 안 좋음 (Service responsiveness)

- 구매 조건이 안좋음 (Price and payment terms)

- 품질이 안좋음 (Product quality)

이 때 covered market = customers competed for and lost + share of market임

고객만족도 분석

- 일단 항목 전체의 평균치 비교

- 그리고 각 elements 별로 경쟁사 대비 잘하는지 못하는지 비교

- 더 나아가 고객에게 중요도가 어떤지를 계산해서 비교

- 가중치 계산해서 고객에게 중요한 부분에서 잘하는지 못하는지 파악해야 함

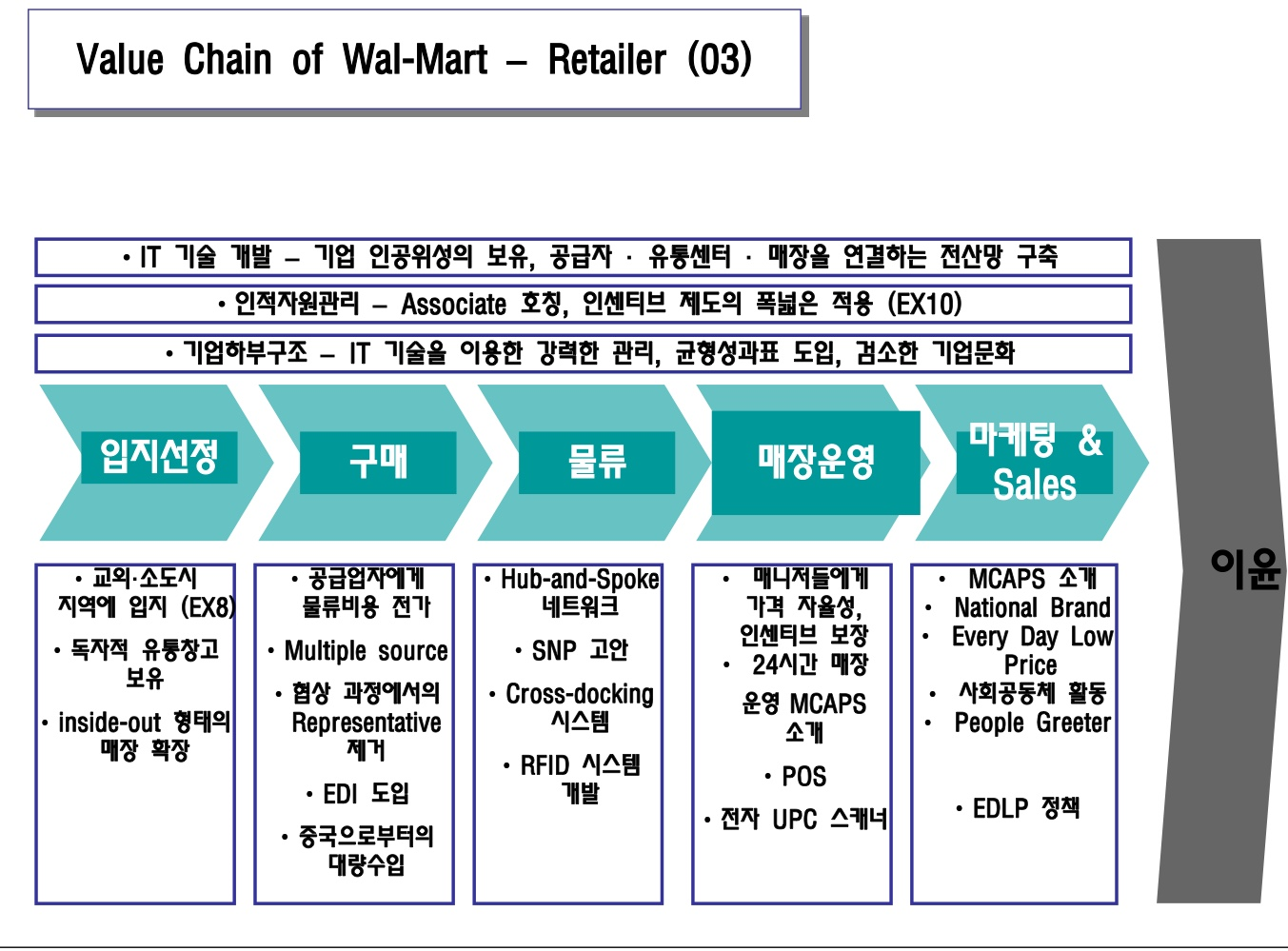

3. 기업 가치사슬

- value added chain

앞에서 산업의 가치사슬을 봤었다

이와 다른 점은, 기업의 가치사슬은 산업과 비슷하게 공통적으로 value를 창출할 수도 있지만

일반적인 산업과 다르게 value를 창출할 수도 있기 때문이다

월마트의 경우를 보자

월마트는 value chain 전반에 있어서 원가 절감이 되도록 한다.

이를 통해 전체적으로 원가 절감 해서 value를 add한다

* 입지선정 : 교외, 소도시 지역

* 구매 : 싼 가격에 납품 (박리다매, 월마트 납품으로 reputation), 글로벌 입지

* 물류 : hub and spoke (허브에 각 제조업체 모인 후, 각 매장으로 보냄)

* 매장운영 : 스캔 시스템으로 물류관리 자동화

* 마케팅/세일즈 : everyday low price (최저가 보장제)이처럼 가치사슬을 통해 어떤 활동이 net value와 margin을 adding 하는지 살펴볼 수 있고,

어떤 활동이 가치를 주지 못한다면 그 부분을 다시 한 번 왜 그렇게 하는지 분석해볼 수 있을 것이다.

4. 자원과 역량/핵심역량

자원과 역량

- Resources

- Capabilities

를 2*2 Matrix에 배치한다

- 전략적 중요도 : segment, industry에서 KSF에 가까운 것은 전략적 중요도가 높은 것

- 상대적 강점 : value chain을 분석하여 배치

핵심역량 (CC, Core Competence)

지속가능하고 남들이 모방할 수 없는 차별화된 역량

- 이를 통해 지속가능한 경쟁우위를 확보하게 해줌

- 모든 기업이 핵심 역량을 가지고 있는 것은 아님

VRIO Analysis

- Valuable : 가치 창출하느냐

- NO -> 가치창출 못함 : Weakness

- Rare : 흔하지 않은가

- NO -> 가치창출은 하지만 흔해서 just Strength

- Hard to Imitate : 따라하기 어려운가

- No -> 나만 가지고 있는 장점이지만 쉽게 모방 가능함 : Strength and Distinctive Compentence (강점+차별화된 역량 but 일시적인 강점)

- Exploited by Organization : 조직이 잘 활용하고 있는가

- 가치 창출하고, 자사만 가지고 있으며, 모방하기도 어렵고 조직이 잘 활용하고 있기도 함

-> 핵심역량!!!!

역량파괴적 환경변화

- 대체 기술, 상품의 등장, 기존 시장의 소멸, 규제 변화 등

- 이러한 역량파괴적 환경변화가 일어나는 상황에서 기존의 강점에만 집착하면 경쟁력을 상실할 가능성이 높음

ex1) KODAK

디지털 카메라의 등장에도 필름 및 인화지 분야의 기존 분야에 집착하여 도산함

ex2) Sears

인터넷과 홈쇼핑 등 새로운 매체가 등장할 때, 매 계절 발행되는 카탈로그라는 전통에 집착해 경쟁력 상실

ex3) Panasonic

기존 강점 : VCR 표준화를 통한 글로벌 생산체제

CD, MP3등 새로운 멀티미디어 기술 등장에 적응치 못하고 몰락

ex4) Nokia

기존 강점 : 규모의 경제를 통한 값싸고 효율적인 휴대전화 생산

2000년대 후반 스마트폰의 등장으로 결합된 생태계구축이 KSF가 됨.

5. 조직문화/구조

조직문화

1) 우리 기업은 어떤 기업이고, 우리는 누구냐?

2) 조직에서의 적절한 행동이 무엇인지에 대한 준거 기준

따라서 기업 내의 사람들의 행동을 결정 짓고 전략적 방향을 결정, 변화시키는데 영향을 줌

예를 들어 고대 vs 연대의 조직문화

M&A나 비슷한 규모의 회사를 합병 시 매우 중요한 issue임

조직구조 (Organizational Architecture)

- Empowerment : 누가 결정하는가

- Motivation : 인센티브가 뭔가

- Evaluation : 제대로 결정했는지 어떻게 평가하는가

조직이 어떻게 돌아가는지는 매우 중요!! 아무리 좋은 전략을 짜도 실행을 잘 해야 함

'𝓡𝓸𝓸𝓶5: 𝒦𝑜𝓇𝑒𝒶 𝒰𝓃𝒾𝓋 > 경영전략 Management Strategy(BUSS402)' 카테고리의 다른 글

| [경영전략] 5. 사업포트폴리오조정과 시너지 창출 - 기업전략 (1) | 2022.12.12 |

|---|---|

| [경영전략] 4. 지속가능한 경쟁우위창출을 위한 전략 - 경쟁전략 (0) | 2022.12.11 |

| [경영전략] 2. 경쟁전략수립 - 외부환경분석 (0) | 2022.12.10 |

| [경영전략] 1. 전략 프레임워크 및 비전 (0) | 2022.12.10 |