1. Bond란?

Bond는 우리말로 채권을 의미한다.

정부나 회사 등이 자금조달을 위해 발행하며,

원금과 이자를 정해진 날짜에 holders of the bond에게 지불하기로 약속된 a long-term debt instrument 이다.

bond와 관련된 용어는 다음과 같다.

- Par Value (액면가액 : 발행인이 만기시에 지급해야 하는 금액)

- Coupon Interest Rate (액면 이자율 : 채권액면상에 표시되어 있는 이자율)

- Coupon ($) = Coupon Rate * Par Value

- Maturity Date : when the par value is repaid (만기일 : 액면가액을 지불해야 하는 날)

- Special Features

- Call provisions : 채권 구매 계약에서 issuer(발행인)에게 만기일 이전에 채권을 조기에 상환할 수있는 권리를 부여하는 조항

- Conversion options : bondholders(채권자)가 bonds를 발행회사의 common stocks(보통주)로 전환할 수 있는 권리

- Different types of Bonds

- Fixed rate bonds, Floating rate bonds 등...

Bond Markets

- 보통 채권은 Over-the-counter (OTC, 장외시장) market 에서 거래된다

- 채권의 대부분은 대형 금융기관이 소유하고 거래한다.

- OTC 시장에서 일어나는 채권 거래에 대한 모든 정보는 공개되지 않는다.

2. Bond Valuation

- Vb = Value of Bond : 채권의 현재 가격

- INT = 쿠폰 이자 (매 달 받는 이자)

- kd = required return 요구 수익률. 투자자가 원하는 수익률. 기대수익률

- N = 만기일까지 남은 년도수

- M = 채권 하나의 액면가액, 보통 1000$

즉 채권의 현재 가치는,

액면가액이 만기 N년 전인 지금 가지는 가치 + N년 간 받는 이자 총합의 오늘의 가치임.

만약 M = 1000$, INT = 80$ (annual), kd = 10%, N = 12 년 이면

Vb = 80*[PVIFA_kd, N] + 1000*[PVIF_10%,N]

만약 여기서 Required Return이 8%가 된다면?

일단 coupon rate 는 $80 / $1000이라서 8%!

i = 8% < kd = 10%

Bond value < Par value (M)

-> discount bond

: 쿠폰으로 얻는 돈보다 기대 수익률이 높다는 건, 액면가보다 싸게 샀다는 것

i = 8% = kd = 8%

Bond value = Par value (M)

-> Par bond

: 쿠폰으로 얻는 이익 = 기대수익률

i = 8% > kd = 6%

Bond value > Par value (M)

-> Premium bond

: 쿠폰으로 얻는 돈보다 기대 수익률이 낮다는 건, 액면가보다 비싸게 샀다는 것

discount bond는 만기가 짧을수록 PV, 현재 가격이 높아지고 (길면 리스크 커서 할인율 올라감)

premium bond는 만기가 길 수록 현재 가격이 높아진다. (길면 이자 많이 받을 수 있어서 가격이 올라감)

3. Bond's Return

Total Rate of Return = Current Yield + Capital Gains Yield

Beg. Bond Value = Purchase price

End. Bond Value = Sale price

Current Yield = C.Y.

= coupon interest payment

= Annual Coupon (INT) / Beg. Bond Value

= 받은 Annual coupon (INT) / 채권 구매 가격

Current Gains Yield = C.G.Y.

= price change

= (End.Bond Value - Beg. Bond Value) / Beg. Bond Value

= (판매가 - 구매가) / 구매가

시장에서 Bond의 현재 가격 PV를 알 수 있지만, 그게 return은 아님

Yield to Maturity (YTM) = 만약 내가 지금 이 가격으로 사서 만기까지 들고있으면 벌 수 있는 채권의 이익율

Yield to Call (YTC) = 내가 사서 called 될 때 까지 갖고 있을 때 얻을 수 있는 이익율

위에서 언급한 kd = required return = YTM임

* APR = Annual Percentage Rate : 연간이율

4. Risk of bonds

1. Interest rate Risk (Price Risk) : 금리 리스크

- 금리 변동에 따라 투자의 가치 변동 (금리 상승 시 가치 하락)

long term bonds => price 변동 더 큼 = more interest rate risk

zero coupon => price 변동 더 큼 = more interest risk for lower coupon bonds

2. Reinvestment Risk : 재투자리스크

- 1이랑 반대의 implication.

- 투자수익금을 재투자할 때 금리 변동에 의해 수익이 달라질 수 있음

- 시장 이자율이 높아지면 이득(가치 상승)

- higher coupon, shorter maturity == risk 증가

단기 채권일 수록 가격 변동 더 큼 = 채권 수입이 감소할 위험

무이표채는 재투자 위험이 없음. 만기까지 보유시 YTM = 실현수익률

3. Default Risk : 채무 불이행 리스

- bond rating으로 측정 = 채무를 이행할 수 있는 issuer의 능력

- 일반인이 추정 거의 불가능

- Bond rating agents가 추정해줌 (S&P, Moody's, Fitch...)

- AAA, Best rating, lowest default risk 등

- Bond rate은 bond issue가 채무불이행 할 확률을 반영함

1. Stocks and Their Valuation

Common Stock

- creditor(채권자)와 preferred stock holders(우선주권자) 에 대한 이자와 배당금 지급 이후 소득에 대한 주장..?

- ownership을 나타내며, ownership은 control을 의미함

- shareholders(주주)는 cash flow rights와 control rights를 얻음

- Control Right = 투표권 Voting Rights : 1 share 1 voting (10% 주식 => 10% 투표 지분)

(prefered 는 보통 없음)

- Cash Flow Right : dividend 받을 권리 (prefered보단 밀림)

- Limited liability

Advantages of Financing with Stock

- 고정된 지출이 필요없음

- 만기가 없음

- 채무 불이행이나 상이 없음

Disadvantages of Financing with Stock

- shareholders의 지배력을 잃을 수 있다 (dilution of ownership)

- 미래에 얻는 수익을 새로운 stockholder(주주)들과 나눠야 함

-> Dilution of ownership

- 부채 대비 flotation cost 증가함

- component cost of capital 증가 <- 뭔데

- 부채가 너무 적으면 takeover bid

Stakeholder = 이해 당사자, Shareholder = 주주

Intrinsic Value and Stock Price

- 외부 투자자, 기업 내부자, 분석가들은 주식의 intrinsic value(내재가치)를 추정하기 위해 다양한 방법을 사용함

- equilibrium(평형상태)에서 주가는 intrinsic value와 같다고 가정한다

- 외부인들은 어떤 주식을 사야하고 팔아야 할 지 결정하기 위해 intrinsic value를 추정하려고 한다

- 주식 가격이 intrinsic value보다 낮은 주식은 저평가 된 것이므로 구매해야 한다.

이러한 intrinsic value를 추정하는 방법에는

- Dividend growth model

- Corporate value model

- Using the multiples of comparable firms

이 있다.

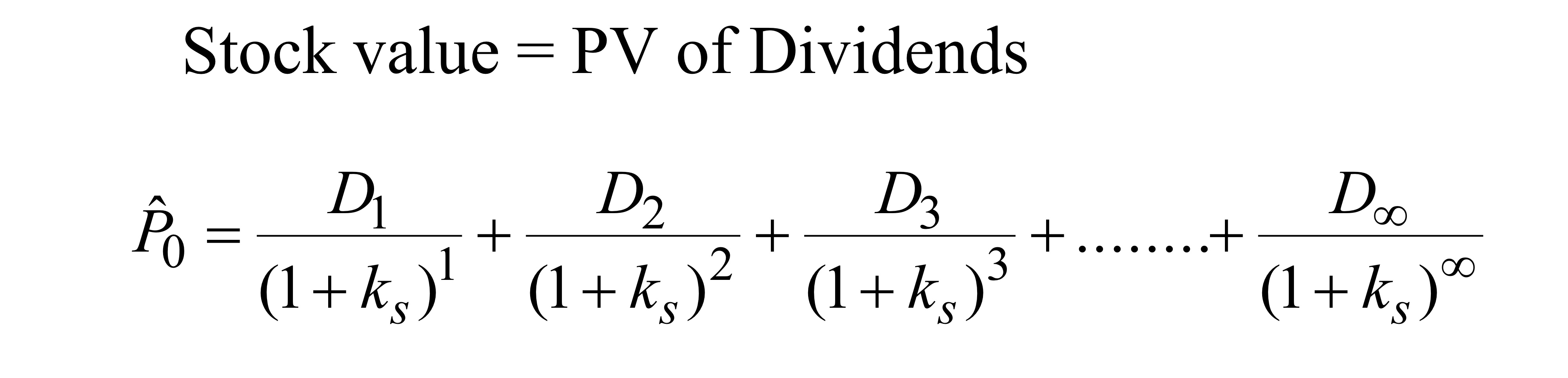

Stock Valuation

1. Dividend growth model

다음의 dividend growth patterns(배당증가패턴..) 중 하나를 따른다고 가정한다.

1. Constant growth rate in dividends (일정한 증가)

2. Zero growth rate in dividends (배당금 성장 제로)

3. "Supernormal" (non-constant) growth rate in dividends (비일정 증가)

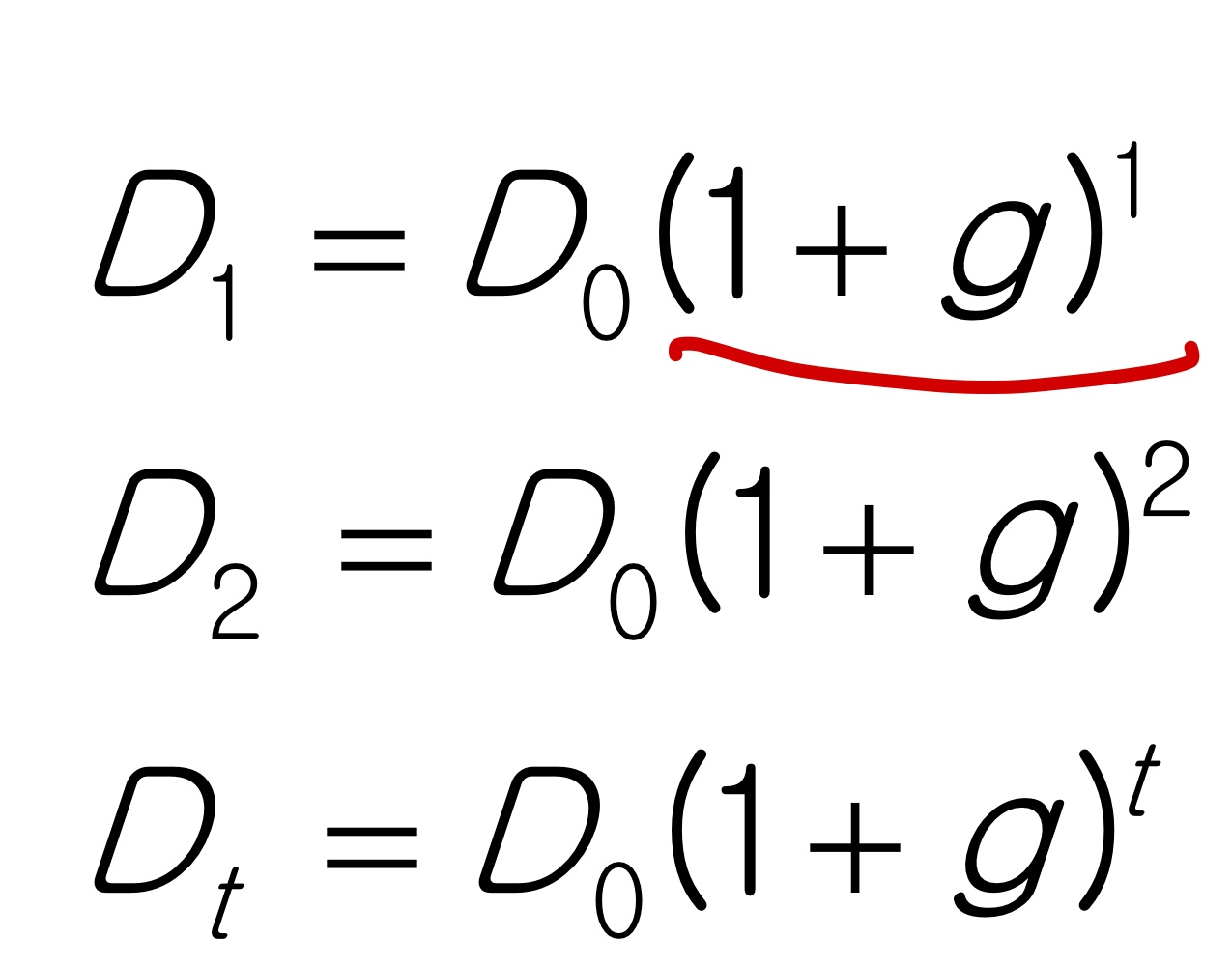

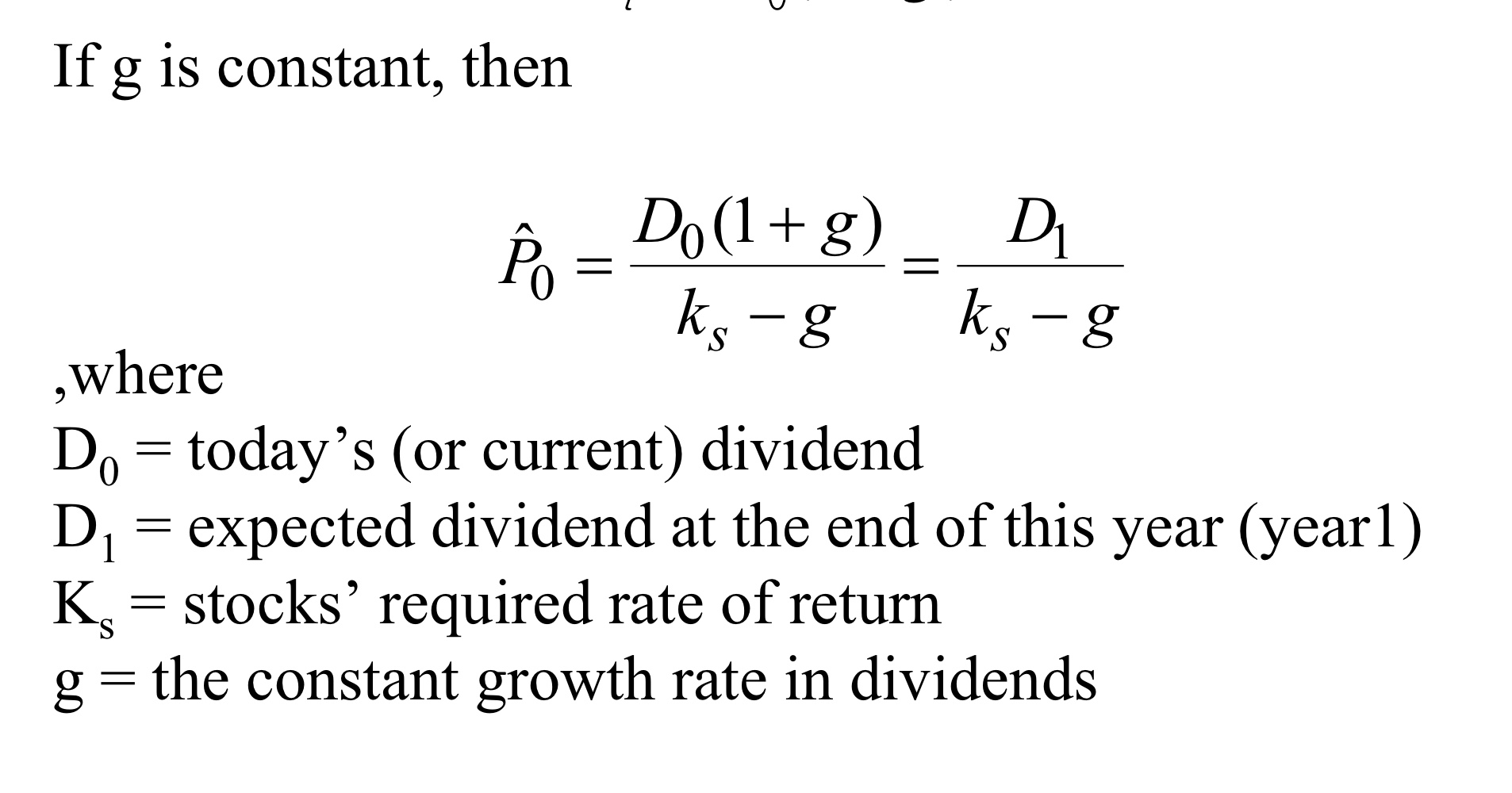

1) Constant growth Stock Valuation Model

-> 일정한 비율로 증가

D0= current dividend -> pay out?

2) Expected Return of Constant Growth Stocks

Expected rate of return

= Expected dividend yield + Expected Capital Gains Yield

= D1/P0 + g

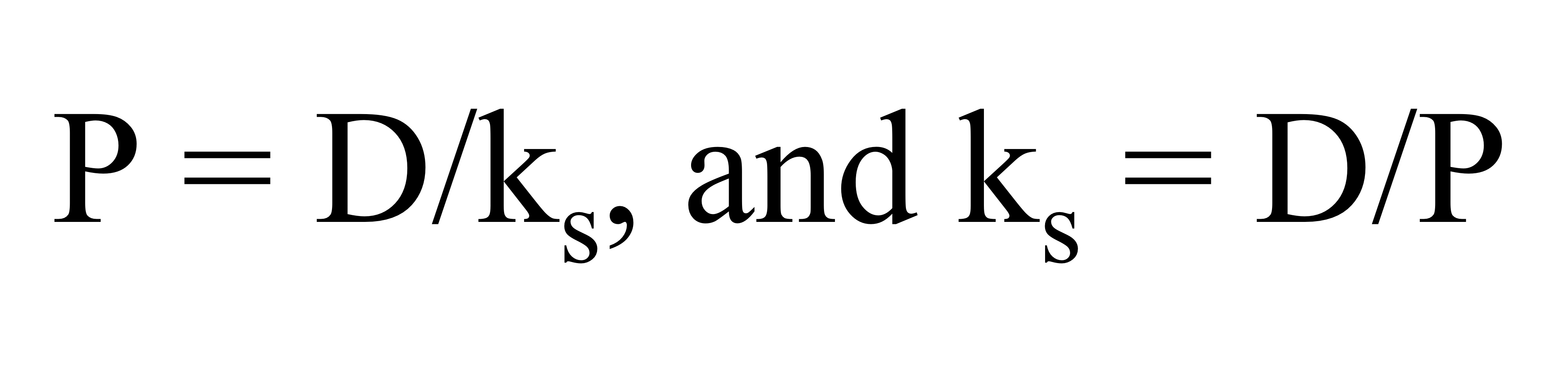

3) Zero Growth Stock Valuation

- constant growth valuation g=0

4) Supernormal Growth Stock Valuation

배당금과 수익이 일정하지 않게 성장하다가 언젠가 정상적인 일정한 normal constant growth pattern으로 정착한다고 가정한다.

- "supernormal" growth period 동안의 배당금을 추정

- supernormal 이 끝나고 constant growth 가 시작되는 시점에서, constant growth dividends 의 PV를 통해 가격을 추정한다.

- supernormal dividend와 constant growth price의 PV를 구한다.이 PV들의 모든 합계가 현재 주식의 가치다.

Preferred Stock Characteristics

: 우선주의 특성

1. 보통주와 달리 no ownership interest

2. 파산 상태시 채무자에 이어 두 번째로 회사 자산에 대한 청구권을 가짐

3. 채권과 마찬가지로 일반 주주 배당금 지급 이전에 fixed dividend를 받음

4. 연간 배당 수익율은 액면가의 n %

5. Preferred dividends는 common dividends보다 먼저 지급되어야 한다.

- Cummulative : 축적 (참여권 우선주) : dividend 축적을 해서 받음 (못 준거 다음에 받을 수 있음)

- new : dividend 비율이 고정되어 있음

- old : dividend 비율이 달라짐

- Non - Cummulative : 비축적 (비참여적 우선주)

Preferred Stock Valuation

- 만기일 없이 평생 같은 배당금을 주기로 약속함

- V_ps = D / k_ps

- growth rate 의미 X

Expected Return on Preferred Stock

2. Corporate Value model

= free cash flow method

전체 기업의 가치가 기업의 free cash flow의 현재 가치와 같음

* free cash flow = 회사의 세후 영업 소득 - 순 자본 투자

FCF(Free Cash Flow)

= NOPAT - Net capital investment

= EBIT(1-T) - (NWC + Capital Expense)

PV(미래 FCF) = 기업가치

기업가치 - 부채 - 우선주 = 보통주의 Value

보통주의 value / 발행 주식 수 = intrinsic stock price

FCF = OCF - NWC - Cap.Exp

OCF : Operating cash flow

= NOPAT + Depr.Exp

Issues regarding the corporate value model

- 배당금을 지급하지 않거나 배당금을 예측하기 어려운 기업을 고려할 때 dividend growth model을 선호하는 경우가 많음

- 이와 유사하게 free cash flow가 일정한 비율로 증가할 것이라고 가정함

- Terminal Value ( TVN ) 은 성장이 constant 해 지는 순간의 기업 가치를 나타낸다.

TVn = FCFn+1 / (r-g)

r : 할인율, 요구수익률, cost of capital

g : growth rate

FCFn+1 : n+1번째의 free cash flow

Value of equity(자기자본가치) = value of firm - value of debt

Value per share (주당가치) = value of equity / # of shares

3. Firm multiples method

분석가들은 주식 가치를 판단할 때 다음과 같은 multiples을 주로 사용한다.

- P / E = 주가 / 주당 순이익(EPS = 당기순이익 / 유통주식수)

- P / CF

- P / Sales

--> 업계 평균 값 * 평가 대상 기업의 값 구하면 추정 주가가 나옴

2. Market equilibrium

- 주식 가격이 안정적이고 사는 사람과 파는 사람의 비율이 비슷비슷함

equilibrium 상태에서 두 가지 조건

- 현재 시장 주가는 intrinsic value와 같다.

- Expected return과 required return이 같다.

Expected return은 dividend와 expected capital gains을 추정해 결정한다 (DCF; Discount Cash Flow)

required returns은 risk를 추정하고 CAPM을 적용해 결정된다.

만약 가격이 intrinsic value보다 낮으면...

- 현재 가격 P0가 너무 낮은 할인을 제공

- 구매가 판매보다 많을 것

- P0가 expected return = required return이 될 때 까지 bid up

'𝓡𝓸𝓸𝓶5: 𝒦𝑜𝓇𝑒𝒶 𝒰𝓃𝒾𝓋 > 재무관리 Financial Management(BUSS207)' 카테고리의 다른 글

| [재무관리] CH6. The Basics of Capital Budgeting (0) | 2023.06.10 |

|---|---|

| [재무관리] CH5. Cost of Capital (1) | 2023.06.10 |

| [재무관리] CH3. Risk and Rates of Return (0) | 2023.04.21 |

| [재무관리] 2. The Financial Environment : Interest Rates (1) | 2023.04.20 |

| [재무관리] 1. Time value of money (0) | 2023.04.20 |