1. What is Risk?

Risk : an uncertain outcome or a chance of an adverse outcome

어떤 불확실한 결과나 안좋은 결과에 대한 가능성이 있는 것

low or negative actual return을 얻을 가능성과 연관되어 있다.

그럴 가능성이 크면 클 수록 투자가 더 risky 해짐

Probability distribution : 모든 가능성을 전부 나열해놓고, 각각의 발생 확률을 나타낸 그래프

위 그래프의 경우 expected rate of return, 쉽게 말해 기댓값(평균)이 15이며, Firm X보다 Firm Y가 더 넓게 퍼져있으므로 표준편차가 더 크다.

단독 자산의 경우, 일반적으로 표준편차가 클 수록, 즉 분포가 넓게 퍼져있을 수록 Return 역시 크다.

Stand Alone Risk : Single Asset relevant risk measure is the standard deviation of expected cash flows

자산 하나의 risk는 expected cash flow의 표준편차로 알 수 있다 !!

Portfolio Context : asset 여러 개의 그룹

- Diversifiable risk

- Market risk

가 존재한다

[예시]

비가오면 10%, 안오면 -5%인 X와

비가오면 -5%, 안오면 10%인 Y를 둘 다 사면

비가 올 때의 기댓값 = 안 올 때의 기댓값 = 2.5% 로

비가 오든 안 오든 2.5% 이득을 볼 수 있다!

따라서 여러 asset을 사면 Firm Specific(Non-systematic, Diversifible risk)는 얼마든지 제거 가능하다.

하지만 Market risk (systematic, non-diversifible risk)는 제거가 불가능하므로 이 값을 예상하는 것이 중요해진다.

물론 에셋 수가 작은 그룹의 경우 Diversifible risk는 여전히 남아있다. 이 risk는 portfolio의 표준편차에 관련되어 있으며, 각 asset return의 correlation이 이 portfolio standard deviation에 영향을 준다.

General Comments about risk

- σ ≈ 35% for an average stock . 일반적으로 평균 주식의 경우 표편이 35% 정도임

- 대부분의 주식은 market 과 positively correlated 되어 있다. (즉, 어느 정도 비례함. 0과 1 사이의 ρ(correlation coefficient, 상관계수)를 가짐)

- 주식을 결합해 portfolio를 만들면 risk가 작아진다

- 표준편차는 포트폴리오에 주식이 추가됨에 따라 감소한다. (기존 포트폴리오랑 완벽히 positively correlated 되어있는 것은 아니기 때문)

- 주식을 추가하면 추가할 수록 점점 diversification benefits이 줄어든다. (10개 이후) 따라서 large stock portfolios에서 포트폴리오의 표준편차는 20% 정도로 수렴한다.

Well-diversified Portfolio

- 따라서 좋은 large portfolio는 10-15 assets정도이고, 이 때 diversifiable risk를 가장 효과적으로 줄여준다

- market risk와 관련된 risk는 diversified를 통해 없앨 수 없다

- Beta라는 risk measure은 market portfolio와 관련된 각각의 asset의 risk를 측정하는 방식이다

Holding Period (Realized) Return

HPR = ( Selling Price - BuyingPrice + Dividens ) / Buying Price

즉 내가 산 가격, 판 가격을 다 알고 있을 때 나의 수익률을 계산하는 방식임

50$에 사서 3$의 배당금을 받고 54$에 팔면 4+3 / 50 = 14% 인 것!

CGY (Capital Gains Yield) : 오직 사고 판 것으로 얻은 수익률 (배당금 제외)

위 경우 4/50 으로 총 8%

DY (Dividens Yield) : 배당금으로 얻은 수익률

3/50 = 6%

2. Single asset 의 return

Asset 하나 일 때의 return 기댓값, 즉 평균 return 값은 (당연히도) 확률*값의 총합이다.

만약 return 값을 모른다면, 이전 return 값들의 평균을 통해 k를 구한다.

Coefficient of Variation

대부분의 투자자들은 risk averse, 즉 risk를 회피하고 싶어하고, risk가 높을 수록 더 높은 return을 요구한다.

CV는 expected return 당 risk의 크기를 알려준다.

CV = s/E(k)

3. Portfolio Risk and Return

포트폴리오의 평균 return 값은, 각 asset들의 return의 평균값을 가중합 한 것이다

포트폴리오의 riskiness는 각 asset의 return들 간의 relationship에 의해 결정된다.

이러한 relationship을 측적하는 것이 바로

correlation coefficient (=ρ)

-1<= ρ < =+1

ρ 값이 작을 수록 risk가 작은 것임!

조금 수식적으로 들어가보자면.....

E(AX+BY) = AE(X) + BE(Y) 이지만,

분산은 단순히 뜯어서 하면 안됨

V(AX+BY) = A^2V(X) + B^2V(Y) 가 아닌!

오랜만에 보는 Cov.. 공분산이 나온다. 공분산은 간단히 말하자면 두 확률 변수 간의 관계를 나타내는 값이다.

공분산이 양수면 비례, 음수면 반비례하지만, 어느정도 상관관계를 갖는지 분석하기에는 부적절하다고 한다.

이 때, "어느 정도 상관관계를 갖나" 를 판단 하는 것이 바로바로 상관계수 ρ

그렇다고 한다.

아무튼 이러한 식을 가지고 우리는 상관계수를 구해낼 수 있다.

그리고 이렇게 구한 상관계수가 작으면 작을 수록 RISK는 감소한다는 점~

실제로 그냥 가중합해서 구하는 표준편차보다, 위의 공분산이 포함된 실제 표준편차 값이 더 작다.

따라서 포트폴리오 잘 구성하면 리스크가 더 작아지는 고런 효과를 볼 수 있는 것

만약 상관계수가 1이라면 표준편차는 그냥 가중합을 한 것과 실제 표준편차와 같아진다.

WHY? V(aX+bY) = a^2V(X) + b^2S(Y) + 2ab(S(X)S(Y)) = (aS(X) + bS(Y))^2

이니까 s = a*s1 + b*s2

상관계수가 작아지면 가중합을 해서 구한 표준편차보다 점점 더 작아지겠죵

4. Market Risk

asset을 포트폴리오에 추가할 수록 risk는 감소한다.

하지만 그럼에도 여전히 market risk는 남아있고, 이를 측정하는 것이 바로 Beta!

Beta는 각 asset의 수익률이 시장에 따라 어떻게 변하는지를 알려준다.

b = 1 : market과 리스크가 같다

b < 1 : market보다 리스크가 작다

b > 1 : market보다 리스크가 더 크다

이 beta는 stock의 return(y)과 market의 return(x) 사이의 regression line의 기울기를 뜻하기도 한다.

(y= a+bx)

포트폴리오의 beta는 그냥 각 stock의 beta를 가중 합 하면 된다!

bp = ∑ wibi

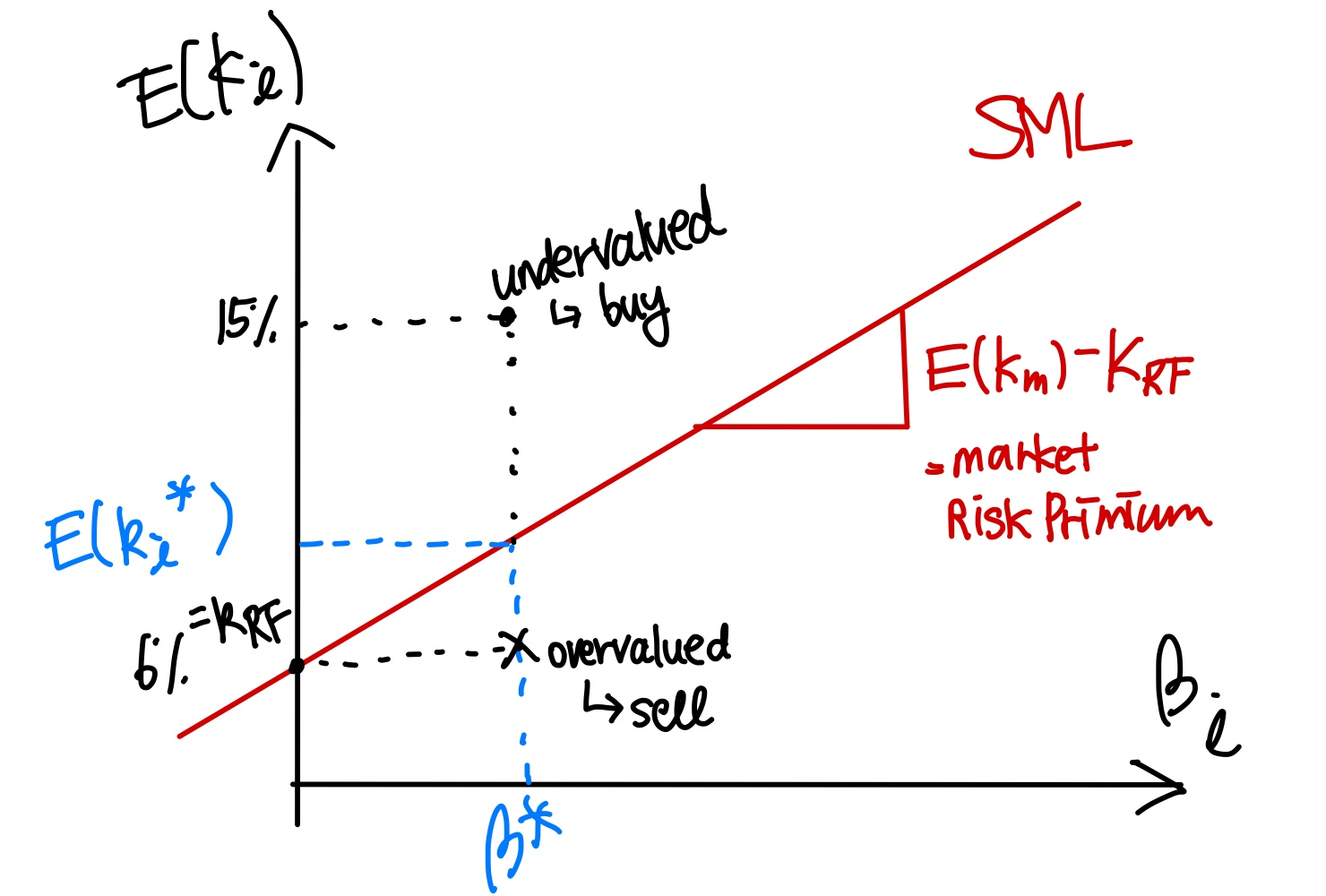

CAPM / SML Equation

CAPM : the Capital Asset Pricing Model

SML : Security Market Line

만약 투자자가 아주 잘 다양화된 포트폴리오를 가지고 있다면, 그가 신경써야 할 것은 오직 market risk일 것이다.

따라서 해당 주식의 risk premium = measure of market risk * market risk premium !

Market risk premium은 마켓 수익율 - risk free 수익율이다. (프리미엄이 market risk premium만 붙는다고 가정했으니까)

또한 각 asset의 risk premium은 이러한 마켓 rist premium에 beta(얼마만큼 비례하는지)를 곱해주면 된다

따라서 결론적으로

어떤 에셋의 수익율은 Risk free 수익율 + 그 에셋의 rick premium (마켓 RP * Beta) 인 것!

만약 k_RF= 6%, k_M = 11%, b(fund) = 1.8 이었다면

k(fund) = 6% + 5*1.8 = 15% 가 되는 것이다

당연하게도, b_i에 따라 asset의 risk가 결정이 된다.

b_i > 1 : asset이 more sensitive (riskier)

b_i = 1: asset risk = market risk

b_i < 1 : asset이 덜 risky

CAPM = E(k_i) = k_RF + B_i(E(K_m)-k_RF)

로, Asset 의 평균 price를 뜻한다.

만약 수익률 기댓값이 SML 그래프보다 위에 있다면 그만큼 리스크가 더 크게 책정됐다는 것이고(프리미엄이 더 붙어있는 상태), 실제 채권 가치보다 낮게 평가된 것이므로 이 때 사야 한다. 반대로 price가 그래프 아래에 있다면 그만큼

Changes to SML Equation

1. inflation rate의 변화

k_RF = k* + IP

E(k_i) = k_RF + B_i [E(k_m) - k_RF]

k_RF가 증가하고, E(k_m) 역시 IP를 포함하고 있으므로 기울기의 변화는 없고 y절편만 변화한다

즉, IP가 변하면 SML이 평행이동을 한다.

2. Risk Aversion의 변화

risk aversion이 증가하면 그만큼 return을 더 많이 요구한다

k_RF 변화 X

E(k_m) : risk가 올라가므로 증가

따라서 market risk premium이 증가하고 기울기가 더욱 steeper 해진다.

'𝓡𝓸𝓸𝓶5: 𝒦𝑜𝓇𝑒𝒶 𝒰𝓃𝒾𝓋 > 재무관리 Financial Management(BUSS207)' 카테고리의 다른 글

| [재무관리] CH5. Cost of Capital (1) | 2023.06.10 |

|---|---|

| [재무관리] CH4. Bonds and Their Valuation (0) | 2023.06.10 |

| [재무관리] 2. The Financial Environment : Interest Rates (1) | 2023.04.20 |

| [재무관리] 1. Time value of money (0) | 2023.04.20 |

| [재무관리] 0. Introduction (0) | 2023.04.19 |