0. Overview

- Future Value of Single Cash Flow (Lump Sum, 현재 n원의 미래 가치)

- Present Value of a Single Cash Flow (미래 n원의 현재 가치)

- Future and Present Value of Annuities (연금, 매 년 같은 금액 적금 시 모이는 돈)

- Future and Present Value of Uneven Cash Flows (매 년 다른 금액 적금)

- Non-annual Interenst Compounding (비연간 이자복리, 연별 말고 더 자주 적금)

용어 정리

- PV = Present Value (돈의 현재 가치)

- FVn = Future Value (지금으로부터 n년 뒤의 돈의 가치)

- i = 연간 이자율

- n = 년도 수, number of period

- PMT = Periodic annuity cash flow (n원 빌렸을 시 갚기 위해 한달에 얼마씩 내야 하는가)

- Time line

- Type

- 0 : payment가 period 말에 일어날 경우

- 1 : payment가 period 시작할 때 일어날 경우

1. Future Value of a Single CF

지금의 돈 얼마가 미래에는 얼마의 가치를 가질 지 알아보자

FVn = PV * (1+i) ^ n = PV*(FVIF_i,n)

예시를 풀어보자

- initial = $100, 3 years after, i = 10% (i = compounding rate; 할증)

0 -> 1 : 100*1.1 = 110

1 -> 2 : (100*1.1) * 1.1 = 100 * (1.1)^2 = 121

2 -> 3 : 100 * (1.1)^3 = 133.10

즉 100달러가 3년뒤에는 133.1 달러가 됨

풀 때는

- 열심히 계산기 두드리거나

- FVIF 값을 표에서 찾아서 구하거나

- 엑셀을 쓰던가

- financial 계산기를 쓰면 됨

엑셀을 쓸 때는

FV = (rate, nper, pmt, pv, type)

- rate = i

- nper = payment 수, n

- PMT = 0

- PV = present value

- Type = 0 or 1

2. Present Value of a Single CF

미래에 필요한 돈이 지금으로 따지면 얼마일까?

예시를 풀어보자

- FV = $100, 3 years, i = 10% 일 때 PV

PV = 100 * (1/1.1) ^3 = 75.31

즉, 미래에 100달러를 가지려면, 지금 75.31달러가 있어야 하는 거임

3. Annuities

a series of equal periodic cash flows : 같은 기간 간격으로 계속 돈 넣기

PV : n년 동안 N원씩 모은 돈의 현재 가치는 얼마일까?!

FV : 지금 가치로 N원씩 모으면 미래엔 얼마가 될까?!

- Ordinary (type 0)

- PV : period 말에 payment. 매 년 말 돈 모음

- FV : last payment 이자 안 붙고 끝남

- Annuity - Due (type 1)

- PV : period 초에 payment. 매 년 초 돈 모음

- FV : last payment 이자 붙고 끝남

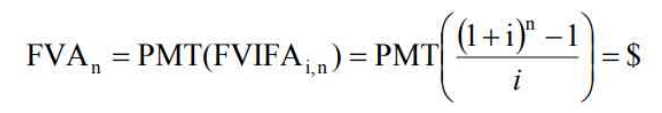

FV of Ordinary Annuity

- 3 year

- ordinary annuity

- 100$의 PV

- i = 10%

FVAn = 100 (마지막 입금) + 110 (2년차 입금) + 121(1년차 입금) = 331

즉, 100달러씩 3년 모으면 3년 뒤에 331달러가 됨

excel로는 FV(rate, nper, pmt, pv, type) = FV(0.1, 3, -100, 0, 0)

FV of Annuity Due

이 경우엔 이자가 마지막에 한 번 더 붙기 때문에, 전체에 이자율을 한 번 더 곱해줘야 함!

FVAn(due) = 110 + 121 + 133.1 = 364.1

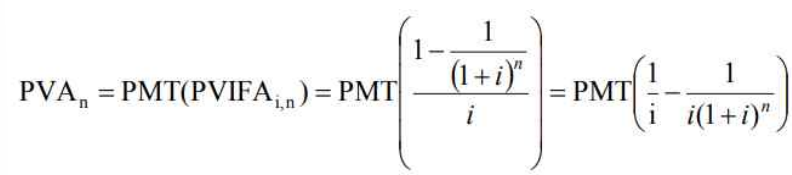

PV of Ordinary Annuity

- 3 year

- ordinary annuity

- 100$의 FV(PMT)

- i = 10%

PVA3 = 90.91 + 82.64 + 75.13 = 248.68

or PMT*(PVIFA_i,n) = 100*PVIFA

즉, 매 달 100달러씩 3년을 모은 돈의 현재 가치는 248달러인 것

excel로는 PV(rate, nper, pmt, fv, type) = PV(0.1, 3, -100, 0, 0)

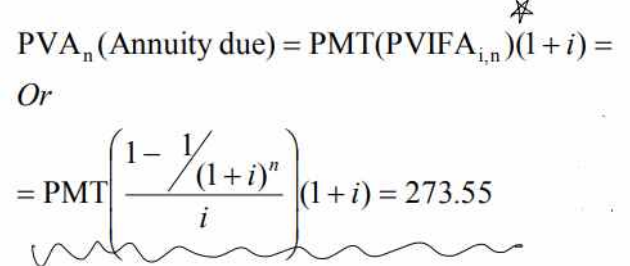

PV of Annuity Due

FV와 마찬가지로 이자를 한 번 더 곱해줘야 함 (1+i)

excel로는 PV(rate, nper, pmt, fv, type) = PV(0.1, 3, -100, 0, 1)

4. Uneven Cash Flows

매 시기마다 넣는 금액이 다른 경우임. 공식화가 어려워서 일일히 계산함

- 1 year : 100

- 2 year : 300

- 3 year : 300

- 4 year : -50

--> 100*(FVIF(10%, 4)) + 300*....

물론 엑셀을 쓰면 계산 편하게 해 줌 !

NPV(rate, value1, value2, value3, ......)

5. Non-Annual Interest Compounding

매 년 넣는 것이 아니라, 특정 기간마다 넣을 경우

1. Annual Percentage Rate (APR)

- Nominal, or stated, or quoted, rate per year

- i_nom

Periodic Rate = i_per : 주어진 기간 단위의 이자율

ex) 8%, quaterly / 8%, daily interest

i_per = i_nom / m

즉, 1년 동안의 평균 이자율을 10퍼센트라고 줬고, 우리는 매 달 pay를 한다면, period별 이자율은 10/12

참고로

- annually : m = 1

- semi annually : m = 2

- quarterly : m = 4

- monthly : m = 12

- daily compounding : m = 360/365

2. Effective Annual Rate (EAR)

- the actual annual interest rate earned or paid : 실제로 내야하는/벌어들인 연간 이자

- m = number of compounding periods per year (1년에 돈 넣은 횟수)

예를 들어 10% APR, Semi-Annual 이라면 100$로 시작 시, 반 년 뒤에는 5% 증가해 105, 1년 뒤에는 그것의 5%가 증가해 110.25가 된다. 이럴 경우 이자율은 10%라고 했지만, 실제로 늘어난 금액은 100->110.25로 10.25%가 된다.

이렇게 "실제로 늘어난 금액" 만큼의 비율을 EAR이라고 한다.

따라서 EAR은 투자를 할 때 각각의 선택지가 얼마의 return을 가져다 줄지 비교할 때 유용하게 쓸 수 있다.

또 다른 예로, BANK A는 5% APR, monthly

BANK B는 5.1% APR, Quarterly라고 해보자

EAR_a = [1+0.05/12]^12 - 1 = 5.12 %

EAR_b = [1+0.051/4]^4 - 1 = 5.20%

가 나오게 된다. 즉, BANK B가 더 높은 이자율을 갖는 것!!

EAR도 nominal rate와 같을 수도 있다. 단, annual compounding일 때만! m이 1보다 크면 무조건 EAR이 nominal rate보다 클 수 밖에 없다

'𝓡𝓸𝓸𝓶5: 𝒦𝑜𝓇𝑒𝒶 𝒰𝓃𝒾𝓋 > 재무관리 Financial Management(BUSS207)' 카테고리의 다른 글

| [재무관리] CH5. Cost of Capital (1) | 2023.06.10 |

|---|---|

| [재무관리] CH4. Bonds and Their Valuation (0) | 2023.06.10 |

| [재무관리] CH3. Risk and Rates of Return (0) | 2023.04.21 |

| [재무관리] 2. The Financial Environment : Interest Rates (1) | 2023.04.20 |

| [재무관리] 0. Introduction (0) | 2023.04.19 |